Kamino Lend Monthly Report July 2025

Kamino Lend continued to expand in July 2025: TVL rose at a double-digit pace as liquidation activity stayed low. This report highlights the principal growth drivers, risk metrics, and milestones

Protocol activity surged across Kamino’s core and V2 markets. Overall supply rose 12.7% to $4.11B while debt climbed 9.7% to $1.66B, pushing TVL to $2.45B (+14.8%). Transaction volume jumped 80% MoM to $9.11B, while borrowers paid $10.1M in interest.

Market dynamics in July reflected a notable shift in positioning: stablecoin borrowing gained ground, led by growth in USDC and USDG debt. SOL remained the protocol’s most supplied and borrowed asset, but liquidity rotated toward high-incentive V2 markets such as Marinade, which grew supply by 28%, and SolBlaze, which surged over 70% MoM. At the same time, large outflows from JLP and a modest contraction in Main’s SOL balances pointed to active reallocation across Kamino’s market set.

July key development milestones:

- xStocks Market launch (SPYx, NVDAx, MSTRx) with Chainlink oracles and price-band risk controls.

- BTCFi expansion via zBTC market in partnership with Zeus Network.

- SwissBorg Earn integration, giving 880k+ users access to Kamino USDG/EURC yields.

- Security milestone: Kamino Earn vaults formally verified by Certora after four audits.

Kamino ends July with deeper integrations, stronger cross-market capital flows, and a lower-risk profile: further cementing its role as Solana’s modular credit layer.

1. Overview of Market Performance

Kamino closed July with accelerated deposit and debt growth, alongside a steady stream of ecosystem launches. Key metrics for the month were:

- Total Supply: $4.11B +12.7%

- Total Debt: $1.66B +9.7%

- TVL: $2.45B +14.8%

- Transaction Volume: $9.11B +80.4%

- Interest Paid: $10.1M +14.8%

- Liquidations: 158 –90.4%

- Collateral Seized: $721K –84.5%

- Distinct Wallets: 124,237 -0.6%

Activity continued to spike across markets as volume rose ~80% month over month. Stablecoins and SOL continued to dominate deposits and borrows, with positioning rotating toward stables as rates and incentives firmed. Liquidations fell sharply along with market volatility.

July saw major integrations and ecosystem milestones:

- Adrena Market (July 9): Tokenized perp pool as collateral.

- xStocks Market (July 14): Tokenized equities (SPYx, NVDAx, MSTRx) as collateral using Chainlink xStocks oracle, with price‑band risk controls.

- Multiply Risk Suite (July 15): Launched real‑time liquidation and rate simulations for leveraged positions.

- Ondo Global Markets Alliance (July 16): Partnership to scale RWA adoption.

- Zeus Network Market (July 17): Added zBTC to Lend V2 with rewards for BTC‑backed borrowing/lending.

- SwissBorg Earn (July 17): Onboarded USDG/EURC yields to 880k+ SwissBorg users.

- Security (July 21): Kamino Earn vaults formally verified by Certora (four audits; open‑source), reinforcing production safety.

These initiatives reinforce Kamino’s position as the modular, capital‑efficient credit layer for Solana for DeFi and beyond.

2. Supply, Borrowing & Revenue Trends

Kamino extended its growth momentum in July, with total protocol supply rising to $4.11B (+12.7%) and debt reaching $1.66B (+9.7%). Growth was broad-based, driven by rotation into stablecoin borrowing alongside increased LST collateral inflows.

The Main Market remains Kamino’s largest market, closing the month at $3.06B supply (+19%) and $1.28B debt, representing over 74% of total liquidity on the protocol.

Other markets showed interesting trends including:

- JLP market consolidation, with supply down to $443M (-17%) and debt to $146M (-21%).

- LST-driven growth:

- Jito rose slightly to $279M supply (+3.7%) and $135M debt (+3%), remaining one of the most competitive and stable LST leverage markets.

- Marinade climbed to $126M supply (+28.5%) and debt up 42%.

- SolBlaze surged to $20.1M supply (+72.4%) and $12M debt (+100%).

- Maple maintained strong uptake at $82.5M supply (+11.8%) and $44.4M debt (+14.1%), led by Multiply integrations delivering 15–20% APY at 5x leverage.

- Exponent contracted sharply to $5.0M supply (–86%) and $2.5M debt (–86.6%) following the Fragmetric TGE, which ended speculative incentive estimates.

- Other V2 markets like Fartcoin and Sanctum are each approaching $20M in supply, with steady but slower adoption across smaller listings.

Asset-level flows were led by LST inflows: JupSOL (+$147M), mSOL (+$45M), bonkSOL, and sustained growth in USDG from ongoing incentives. Outflows were concentrated in JLP (–$108M), SOL (–$91M) after a year of steady growth, and cbBTC (–$84M).

Borrowing trends shifted toward stablecoins: USDC (+$23M) and USDG (+$12M) debt expanded, while SOL (–$42M) and JitoSOL (–$12M) contracted, reflecting stronger stablecoin incentives and more cautious SOL leverage.

Kamino V2 Markets & Vaults

Kamino Lend V2 closed its second full month post launch in July reaching $334M of supply across V2 markets (+18.4%), with $127M borrowed (+17.6%), representing a 263% supply-to-debt ratio. The user base included 3,630 suppliers (+21%) and 1,495 borrowers (+24.5%), with borrowers representing 41.2% of suppliers. Average V2 deposit size stood at $92K, while the average borrower position was $87.5K, reflecting sustained institutional-scale participation. V2 generated $345K in interest over the month.

On the vault side, Kamino ended July with $90 million (+27m MoM) deposited across 15 vaults, with 43% SOL and five major stable assets: USDC, USDG, USDS, and USDT. In July alone, vaults generated $345k of interest to 2,600 suppliers.

The top vaults are:

- USDC Prime curated by Steakhouse Finance with $30M supplied by 775 users. This vault supplies to the 2 Kamino core market: Main and JLP.

- MEV Capital SOL with $21M supplied by 420 suppliers, now lending to 7 markets

- Allez SOL with $13M supplied by 1200 users. This vault lends to the Main, Jito, Marinade, Solblaze, Sanctum & Exponent markets.

3. Kamino Stable Dollar & SOL

July saw stablecoins capturing a larger share of borrowing while SOL lending remained a dominant liquidity driver. Activity in SOL markets softened slightly, reflecting a broader rotation toward stables partially due to incentive-driven strategies.

SOL Markets

SOL markets saw mixed performance in July, with overall balances softening but higher utilization:

- SOL supply fell to 6.27M SOL (-483K MoM)

- SOL debt decreased to 5.52M SOL (-228K MoM)

- Utilization increased to 88% (+3% MoM)

- Supply and borrow rates increased slightly to 5.57% and 7.43% respectively

The Main Market continued to be Kamino’s primary SOL sink, ending the month with 5M SOL supplied and 4.45M borrowed while V2 markets provided incremental but diverse SOL supply and borrow opportunities:

- Jito is the most liquid non-main market with 718K SOL supplied and 618K borrowed

- Marinade grew to 414K SOL supplied and 142K borrowed, showing strong capital efficiency and steady adoption

- SolBlaze grew to 90K SOL supplied and 67.5K borrowed, maintaining high utilization

- Sanctum and the restaking market remained smaller in scale, with limited but consistent usage

Net flows showed large outflows from Main and Exponent, while Marinade and SolBlaze recorded notable supply and debt growth, signalling liquidity rotation toward high-incentive V2 markets.

SOL remains Kamino’s most borrowed and supplied asset, though lending flows are increasingly shaped by vault rewards and LST loop strategies.

Kamino Stable Dollar Markets

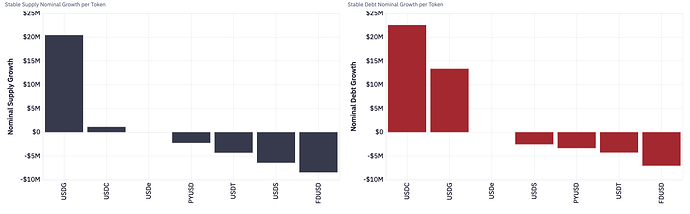

Stablecoin markets strengthened in July, with broad-based gains across supply, borrowing, and utilization metrics:

- Kamino Dollar supply rose $698.3M (+$43.6M / +6.7% MoM)

- Debt increased to $610.9M (+$18.6M / +3.1% MoM)

- Utilization climbed to 87.5% (+2.66% MoM)

- Borrow rate rose to 11.27% (+2.15% MoM)

- Supply rate rose slightly to 8.73% (+2.61% MoM)

The Main Market continues to dominate, holding $538M in stable supply and $477M in debt (88.7% utilization), followed by JLP with $165M supplied and $147M borrowed. The Maple market is growing with $38.8M supplied and $34.9M borrowed, with steady high utilization.

At the token level, USDG led supply growth (+$20M), supported by incentives, while USDC saw the largest debt increase (+$23M) alongside USDG (+$15M). Outflows were concentrated in FDUSD, USDT, and USDS, reflecting a consolidation of borrowing into the most liquid and incentivized stables.

Rates remained volatile through the month, driven largely by cyclical supply and withdrawal activity from large USDG suppliers, but utilization trended upward, highlighting persistent borrowing demand despite rate swings.

Overall, stablecoin markets in July show a more concentrated, capital-efficient profile, with liquidity increasingly anchored in USDG and USDC, and vault-driven demand sustaining high utilization.

4. Transaction Volume and User Behavior

Kamino processed a record $9.11B in total transaction volume during July, up +80.4%, marking a sharp rebound in market activity. The jump was fueled by higher deposit and withdrawal turnover in the Main Market and sustained engagement in V2 markets like Marinade, Maple, and SolBlaze.

Breakdown by transaction type:

- Deposits: $3.64B +83.8%

- Withdrawals: $3.52B +76.9%

- Borrows: $822M +44.5%

- Repays: $775M +30.6%

- Liquidations: $880K –81.1%

- Liquidated debt repaid: $830K –81.5%

5. Market Movements & Liquidations

Volatility remained moderate throughout July, with liquidation activity falling sharply from June’s levels. The few events were concentrated in Main and Fartcoin markets.

Total collateral liquidated reached $721K (–84.5% MoM), with $682K in debt repaid through liquidations. The bulk of seized collateral came from SOL, cbBTC and Fartcoin positions paired with USDC in the Main and Fartcoin markets.

Kamino saw only 158 liquidations across the month (–90.4% MoM), reflecting both lower volatility and stronger collateral buffers. Liquidator participation decreased in line with reduced liquidation opportunities, but coverage remained broad and competitive, preventing any concentration risk. The liquidation volume ratio stayed extremely low at 0.02% of total volume.

6. Stress Testing

Portfolio risk across Kamino markets remained well-contained in July, though positions in key markets like JLP and Main continued to cluster near liquidation thresholds. Liquidation proximity was highest in JLP, where over 60% of accounts remain within 30% of their liquidation threshold. By contrast, the Altcoin and Main markets saw broader collateral buffers and lower systemic risk.

Newer LST-focused V2 markets, such as Marinade and SolBlaze, maintain smaller liquidation margins but are structurally more resilient due to correlation between supplied and borrowed assets, reducing net exposure during price swings.

In a market shock scenario, dominant collaterals SOL, JitoSOL, JupSOL, and JLP would carry the largest liquidation exposure. These assets are also the most liquid and composable on Solana, enabling graceful position unwinding with limited price impact. Trade size analysis shows low slippage and stable price impacts for large sizes across USDC–SOL pairs.

Total Collateral at Risk & Bad Debt Exposure (ceteris paribus):

- Should an instant 30% market drop occur, $164M in collateral could be liquidated (-10% MoM), potentially resulting in $3.5M in bad debt (+0% MoM)

- In a 60% crash scenario, liquidation exposure rises to $763M (-4.4% MoM), with potential bad debt reaching $87.9M (-14.6% MoM) under absolute worst case scenarios.

Both modeled liquidation volumes and bad debt risk declined showing a lower risk profile. Overall, systemic risk remains low, supported by high asset liquidity, improved borrower behavior, and strong liquidation infrastructure.

7. Conclusions & Risk Considerations

Kamino started Q3 with strong protocol expansion, marked by an 80% jump in transaction volumes and steady growth in total supply (+12.7%) and debt (+9.7%). Stablecoin borrowing gained share, while SOL flows rotated toward incentivized V2 markets such as Marinade and SolBlaze.

Liquidations dropped sharply (-90% MoM) alongside calmer market conditions, and stress testing continued to show robust resilience, even under severe drawdown scenarios. Borrower positions in high-utilization markets like JLP remain clustered near liquidation thresholds, but new LST-focused V2 markets benefit from strong asset correlation, reducing net risk.

Vault participation and V2 adoption continued to scale, now accounting for over $300M in supplied liquidity and driving $345K in interest generation in July. These structural shifts, toward vault-led capital deployment, diversified collateral types, and risk-aware borrowing, reinforce Kamino’s ability to adapt incentives and manage leverage without compromising systemic stability.

With multiple integrations completed in July, including tokenized equities (xStocks), BTCFi expansion via zBTC, and SwissBorg Earn onboarding, Kamino enters Q3 positioned to deepen its role as Solana’s modular credit layer. The focus will be on accelerating vault growth, refining capital efficiency, and onboarding new market primitives to capture cross-ecosystem liquidity.