September was a month of steady growth and resilience for Kamino, marked by strong inflows into stablecoins and vaults. Total supply reached $4.4B (+4.9% MoM) and TVL rose to $2.8B (+7.8%), both new highs for the protocol. Borrow demand held steady at $1.6B (+0.5%), reflecting a more cautious risk appetite as market volatility re-emerged at month end.

Kamino’s vault layer continued to gain traction, more than doubling in size to $593M, with USDC Prime and the new PYUSD Sentora vault leading the way. Stablecoin adoption accelerated with liquidity reaching record levels. By contrast, SOL markets saw their second month of contraction as traders trimmed leveraged LST strategies in favor of stable yield products.

With volatility in the last third of September, the liquidation systems performed in an orderly manner. Over 2,000 liquidations were executed, with $6.3M collateral seized and $5.9M debt repaid - a notable increase versus August, but still representing less than 0.25% of overall volume.

September also marked a month of ecosystem-level milestones

- PYUSD growth initiative boosted PYUSD earning opportunities, attracting significant liquidity

- Kamino launched two new RWA markets - OnRe (reinsurance) and Huma (payment-linked financing) - unlocking diversified real-world yield onchain.

- The protocol celebrated its third year on mainnet with no incident nor downtime. Kamino Lend contracts were formally verified onchain, solidifying its transparency and security leadership in Solana DeFi.

1. Overview of Market Performance

September’s growth was fueled primarily by depositor inflows and vault allocations, while borrow demand remained flat. Stablecoins and BTC emerged as the main engines of expansion, as SOL leverage continued to contract for a second month.

Kamino closed the month with:

- Total Supply: $4.4B +4.85%

- Total Debt: $1.6B +0.07%

- TVL: $2.8B +7.79%

- Transaction Volume: $12.3B +3.36%

- Interest Paid: $10.1M +0%

- Liquidations: 2,289 +1,439% due to a low August

- Collateral Seized: $6.3M +4,091% due to a low August

- Distinct Wallets: 114,964 -2.59%

Activity remained high across markets, with volumes spiking during periods of SOL volatility. A major liquidation event in the final week of September drove system-wide stress tests, which were handled smoothly. Stablecoins and SOL continued to dominate supply, each closing just under $1B.

Kamino’s momentum in September was underscored by progress across yield, product, and security:

- PYUSD growth initiative launched with PYUSD incentives, later boosted by KMNO rewards

- Kamino.Finance officially rebranded to Kamino.com, also on X

- Launch of the new Kamino Security page, highlighting risk monitoring and safety practices.

2. Supply, Borrowing & Revenue Trends

Kamino expanded steadily in September, with total supply reaching $4.4B (+4.8%) and TVL climbing to $2.8B (+7.8%), while debt remained broadly stable at $1.6B. Strong volumes point to continued capital reallocation from SOL leverage toward yield, as users rotated into passive vaults and stablecoin-based strategies.

The Main Market remains the protocol’s anchor, closing at $3B in supply (70% of total) and $1.2B in debt, though most other markets consolidated during the month.

Market-level trends:

- LST markets were mixed:

- Marinade inched up to $139M supply & $65M debt

- Jito remained the largest at $278M supply & $129M debt with only a slight contraction

- SolBlaze consolidated sharply to $21.5M in supply (-31.4%) and $17M in debt

- Sanctum and Exponent continued consolidating

- RWA markets saw rising demand:

- Huma grew x4 to $7.5M (+400%) with $3.3M debt

- OnRe reached $13.1M (+44%) with $4M debt

- Maple climbed to $75M supply with debt up (+25.7%) to $51.2M after higher LTVs improved Multiply-powered stablecoin yields

- JLP held steady

- Smaller v2 markets like ZeusBTC, Adrena, Bonk, and xStocks are showing early signs of traction

Asset-level trends

A number of assets experienced large inflows:

- PUSD added $169M in supply, leading assets growth

- cbBTC added $139M in supply, confirming a growing appetite for BTC as collateral

- USDC supply increased by $96.5M, as users rotated into high-yielding vaults

- LSTs also recorded notable inflows dSOL +$90M, JitoSOL +$68M, dfdvSOL +$27M, and MSOL +$20M

Outflows centered on SOL-native assets:

- SOL supply fell by $101M and SOL debt fell by $129M, marking the second month of SOL contraction

- JupSOL fell by $132M, as Jup Lend gained share

On the debt side, growth was led by stables: USDC +$109M, and PYUSD +$29M.

Kamino V2 Vaults

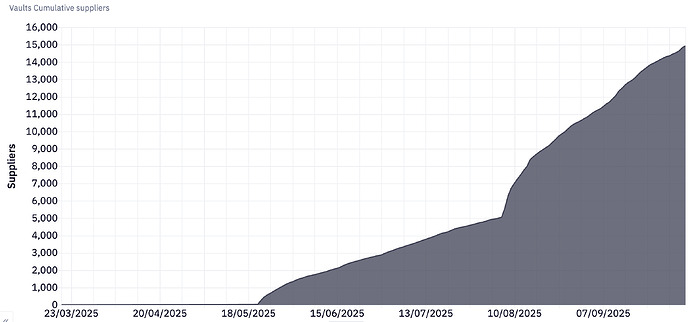

Kamino Lending Vaults continued to gain momentum in September, with deposits more than doubling to $593M (+200%). Stablecoin strategies led the way, highlighted by the rapid rise of PYUSD, which now accounts for 29% of all vault deposits, alongside continued strength in USDC-based vaults.

In September alone, vaults generated $1.7M in interest for suppliers, in addition to incentives, serving a growing community of 14,534 cumulative depositors +121% and 8,495 active ones.

Top Vaults in September:

- USDC Prime, curated by Steakhouse Finance, with $267M supplied (+52%) by 4,677 users (+9.1%. This vault routes capital to Kamino’s Main and JLP markets.

- Sentora PYUSD starting strong with $189M. This vault only lends to the Main markets.

- Allez USDC with $63M (+53.6%) supplied by 1,517 users (+76%), diversified lending to 10 markets.

Vaults are now a core growth engine, bridging stable demand for yield with Kamino’s market infrastructure, while also broadening user participation at scale.

3. Kamino Stable Dollar & SOL

September marked a turning point from Q2 trends: stablecoins returned to growth, matching SOL in total supply while SOL leverage continued to contract. This shift was amplified by vault incentives and reduced appetite for riskier SOL loops during volatile price action.

Kamino Stable Dollar Markets

Stablecoin markets regained momentum in September reaching all time high levels of liquidity:

- Kamino Dollar supply rose $973.3M +$125.7M or 14.7%

- Debt increased to $745.9M +117.3M or 19%

- Utilization increased to 76.6% -2.5%

- Borrow rate increased to 7.2% -1.2%

- Supply rate increased to 4.7% -0.8%

Volatility in borrow rates persisted due to recurring large whale rebalances, causing short-lived spikes in funding costs.

At the market level:

- Main Market dominated with $860M supplied (+47%) and $579M borrowed (+26.7%)

- Maple grew steadily to $57.2M supplied (+30.3%) and $51.1M borrowed (+25.5%), supported by higher utilization after borrow power was increased

- JLP contracted to $124M supplied (–23.9%) and $105M borrowed (–10.2%)

At the token level, PUSD led supply growth with $169M inflows, while USDG lost $20.4m. On the other hand, USDC led debt growth with $105M followed by PYUSD with 25.6M increase in borrows, USDG –$11M, as users pivot to incentivised assets.

At the token level:

- PUSD led with +$169M in new supply

- USDC supply rose +$96.5M, driving vault strategies

- cbBTC added +$139M in supply, reflecting growing BTC collateral appetite

- USDG saw outflows –$20.4M

On the debt side:

- USDC led with +$105M new debt

- PYUSD followed with +$25.6M

- USDG declined –$11M as users rotated into incentivized assets

SOL Markets

SOL markets pulled back across all metrics:

- SOL supply fell to 4.61M SOL (-643K)

- SOL debt decreased to 3.81M SOL (-838K)

- Utilization decreased to 82.8% (-5.8%)

- Supply and borrow rates decreased to 4.8% and 6.8% respectively

The Main Market remained the anchor for SOL liquidity, but contracted alongside V2 markets:

- Jito held 608K SOL supplied -10% and 555K borrowed

- Marinade slightly slipped to 369K SOL supplied and 314K borrowed

- SolBlaze and smaller markets saw sharper contractions

Net flows showed consistent outflows from Main, Jito, and SolBlaze, with no offsetting growth elsewhere. While SOL remains Kamino’s top asset by absolute size, stablecoins are now effectively on par in supply, reflecting a structural rotation.

September confirmed a broad rebalancing toward stablecoins and BTC, supported by vault incentives and competitive rates. SOL remains foundational but is no longer the clear growth engine.

4. Transaction Volume and User Behavior

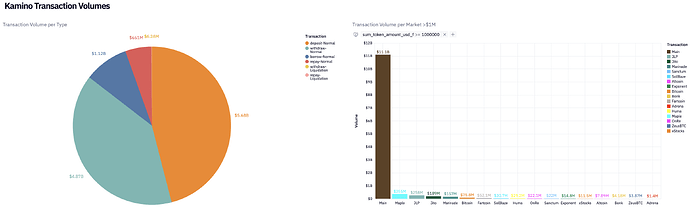

Kamino processed a record $12.3B in transaction volume in September, up 3.4% MoM, with activity remaining elevated across deposits, withdrawals, and liquidations which hit end of the month.

Volume breakdown by transaction type:

- Deposits: $5.68B (+20%) driven by steady inflows into vaults and stables

- Withdrawals: $4.8B (-90.5%) moderate after August’s high churn

- Borrows: $1.12B +(44.5%) with a rebound in borrowing demand, led by USDC and PYUSD

- Repays: $661M (-33.9%) showing reduced deleveraging activity compared to August

- Liquidations: $12.3M (+8,260%) sharp increase from August’s low base, concentrated in SOL and JitoSOL during late-month volatility

Transaction patterns confirm the structural rotation underway: users are actively depositing into vaults and stablecoin markets, while SOL leverage contracts. The liquidation spike reflects conventional operations in times of volatility.

5. Market Movements & Liquidations

Late-September volatility triggered sharp drawdowns - SOL fell nearly 25% and several memecoins lost over 40%. This stress event drove a surge in liquidations, concentrated in SOL, JitoSOL, and Fartcoin collateral positions.

Total collateral liquidated climbed to $6.5M, with the majority tied to SOL exposures in the Main Market. Despite the scale-up, all liquidations were executed efficiently and without generating bad debt.

Kamino recorded 2,289 liquidation events in September, a substantial rise versus the low activity of prior months. Liquidator participation scaled effectively with market stress, ensuring solvency. Fees remained minimal, with average liquidation bonuses just 0.07% of position size, underscoring the depth and efficiency of the liquidator network.

Kamino’s liquidation engine functioned smoothly under stress, preserving protocol health and preventing systemic disruption.

6. Stress Testing

Portfolio risk across Kamino markets remained largely contained in September, though positions edged slightly closer to liquidation thresholds- most notably in the Main and JLP markets. This reflects modest reductions in collateral buffers as users rotated capital and overall borrow demand softened.

LST-focused markets such as Jito, Marinade, SolBlaze, and Sanctum continue to display tighter liquidation margins, but their structure remains resilient. Similarly, yield-stable markets like Maple and OnRe benefited from increased borrowing power. Their design -where supplied and borrowed assets are closely correlated - naturally reduces net exposure and insulates them from price volatility. Notably, these markets have yet to experience a single liquidation event.

In a sharp correction, dominant collaterals such as SOL, JitoSOL, JupSOL, and JLP would carry the greatest liquidation exposure. However, these assets are also among the most liquid and composable on Solana, enabling orderly unwinds with limited price impact. Trade size analysis confirms low slippage and stable execution across USDC–SOL pairs, with slight improvements compared to August.

Total Collateral at Risk & Bad Debt Exposure (ceteris paribus):

- Should an instant 30% market drop occur, $223M in collateral could be liquidated (+13.7%), potentially resulting in $10.6M in bad debt (+65.6%)

- In a 60% instantaneous crash scenario, liquidation exposure rises to $1.03B (+39%), with potential bad debt reaching $115.5M (+8.4%), under absolute worst case scenarios.

While systemic risk remains low, modeled outcomes point to marginally greater vulnerability under moderate shock scenarios (30–40% drawdowns). Even so, Kamino’s deep collateral liquidity and proven liquidation infrastructure continue to provide robust defenses against cascading failures.

7. Conclusions & Risk Considerations

Kamino closed September with another month of growth and resilience. Supply climbed to $4.4B, supported by stablecoin inflows and vault adoption, while borrow demand held steady at $1.6B. Vaults doubled in size to $593M and are now a core engine of protocol growth. Stablecoin markets strengthened to record levels while SOL leverage continued to contract, reflecting a pivot in user behavior toward stability and yield.

As volatility hit, liquidations rose to 2,289 events and $6.3M collateral seized, but were handled smoothly with affected users losing just .07% of their size as fees. Stress testing showed resilience even under sharp price shocks, though modeled bad debt increased modestly.

September highlighted Kamino’s ability to scale in volatile conditions. The pivot toward stables, BTC, vaults, and RWAs has broadened the foundation for growth, while liquidation and risk systems continue to perform effectively. As Kamino enters Q4, the focus will remain on vault expansion, onboarding new markets, and strengthening risk-adjusted yields.